With the continuous expansion of the prohibition and restriction of paraquat and glyphosate worldwide, the problem of pesticide resistance has prompted the growth of demand for non-selective and multi-resistant transgenic crops, as well as the historically low price and the rapid improvement of comprehensive competitiveness. In recent years, Since then, the development of the glufosinate market has accelerated significantly. After glyphosate, glufosinate has grown to become the second largest herbicide. In the past 10 years, the compound annual growth rate (CAGR) of glufosinate in the world is 12.2%, and the sales in 2020 will be 1.05 billion US dollars. Glufosinate has a prominent position in China, which is the world's largest supplier and exporter, and its usage ranks second.

Market analysis

(1) Paraquat ban brings new demand for glufosinate

Paraquat is banned in China, Thailand, Vietnam, Brazil, the European Union and other countries and regions, and the expiration of products circulating in the Chinese market will effectively promote the rapid release of demand for glufosinate.

(2) Glufosinate-resistant and multi-resistant transgenic crops promote the continuous growth of glufosinate

Since 1995, the glufosinate-resistant and multi-resistant transgenic crops developed by multinational companies such as Agrefort, Aventis, Bayer, DuPont Pioneer and Syngenta have been promoted and applied one after another, especially in large field crops such as soybeans, rapeseed and cotton. many.

In 2018, the world used the largest amount of glufosinate in rapeseed fields, followed by soybean fields, and the third was cotton fields. The application of the three crop fields accounted for 46% of the total glufosinate market. The market concentration of these three major crops has increased significantly, and the applications in economic and non-agricultural fields are still growing steadily.

(3) Compounding of glufosinate brings demand increase

Glufosinate has poor systemic property, kills undead roots of weeds, and has unsatisfactory effect on broad-leaved weeds. The combination of glufosinate can effectively resist resistant weeds, overcome the shortcomings of a single herbicide, have a wider weeding range, and kill weeds more quickly and thoroughly. For example, the formula of glufosinate + glyphosate is currently registered and produced by several manufacturers.

(4) There is a linear relationship between the price of glufosinate and the substitution of glyphosate and paraquat

At present, the price of glufosinate has dropped significantly, and the increase in cost performance is conducive to the growth of usage. At present, the price of glufosinate 95% technical is 63,000 yuan/ton, and the price of glyphosate 95% technical is 38,000 yuan/ton, which can replace glyphosate and paraquat in some markets.

Supply Situation

The global production capacity of glufosinate is about 43,000 tons per year, and the production capacity installations are mainly distributed in Germany, the United States, China and India. According to the company's new production capacity news, the global glufosinate production capacity release area is still in China. In terms of production capacity, as of the end of 2020, the global production capacity of glufosinate is about 47,500 tons, and China's production capacity of glufosinate accounts for about 60% of the world, occupying an absolute production capacity advantage.

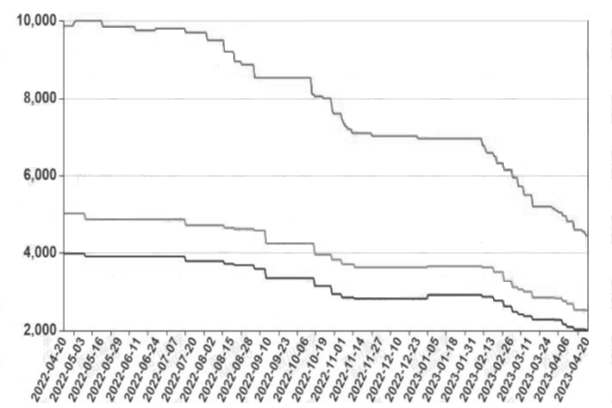

Price Trend

In 2020, the COVID-19 epidemic caused most production enterprises in Hubei to suspend production and production. As the main intermediate supply base for glufosinate in China, the supply-demand relationship of glufosinate caused by the epidemic has become tense again, and the price continues to rise. In 2021, energy consumption and power cuts will lead to a shortage of yellow phosphorus supplies and a sharp price increase. In 2022, the price of glufosinate will rise to 270,000 yuan/ton, a record high in five years. Then the price took a sharp turn. In July 2023, the lowest price of glufosinate has dropped to 63,000 yuan/ton, and the price of refined glufosinate was reported to be 110,000 yuan/ton, breaking through the historical low price of glufosinate. Considering that the domestic industry capacity expansion brought about by technological progress from 2018 will lead to an oversupply of the glufosinate industry, prices may continue to be under pressure in the future.